FIRE & EXTREME WEATHER PLANNING (FIRESIGHT™)

Planning starts with better science.

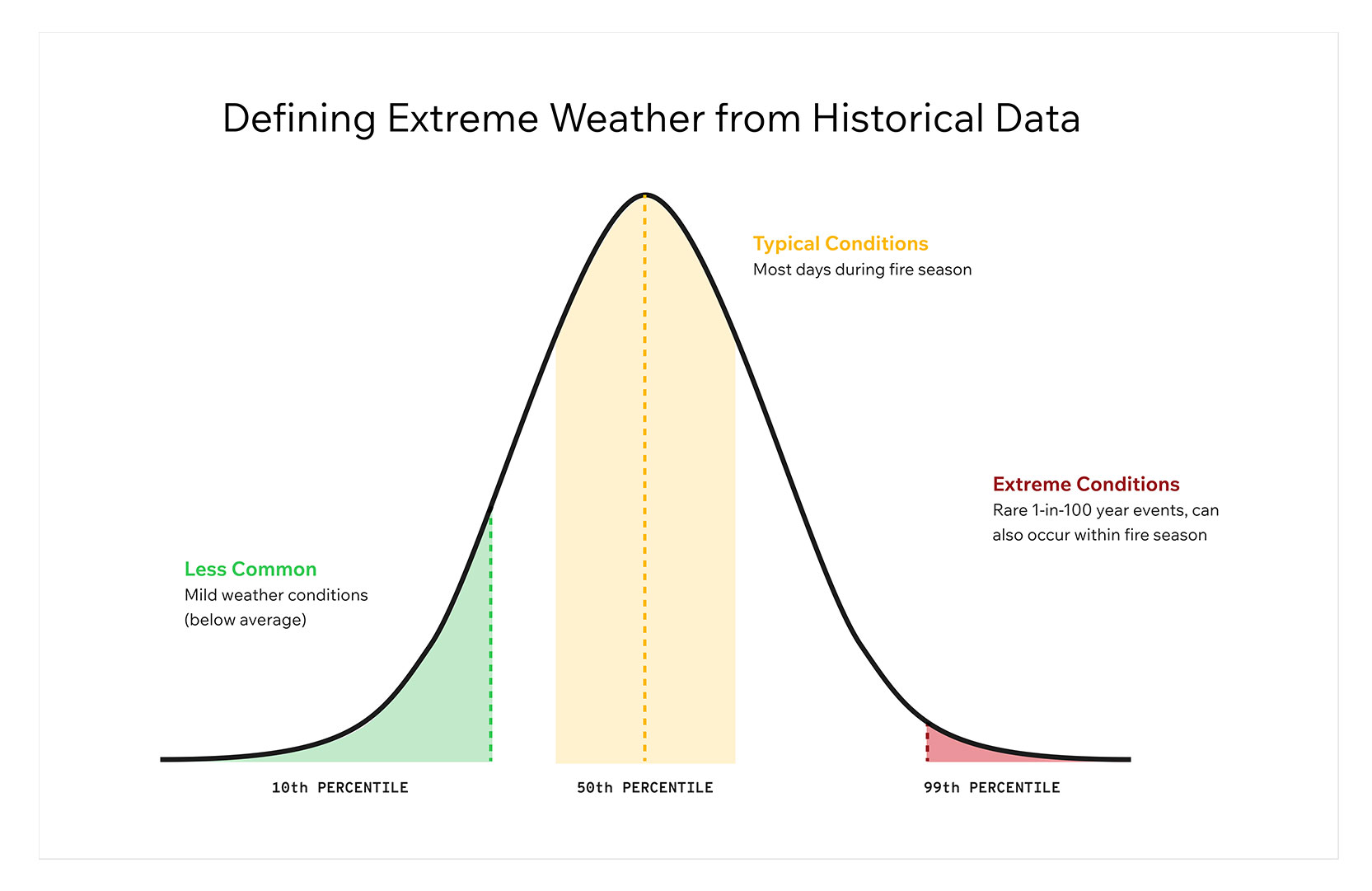

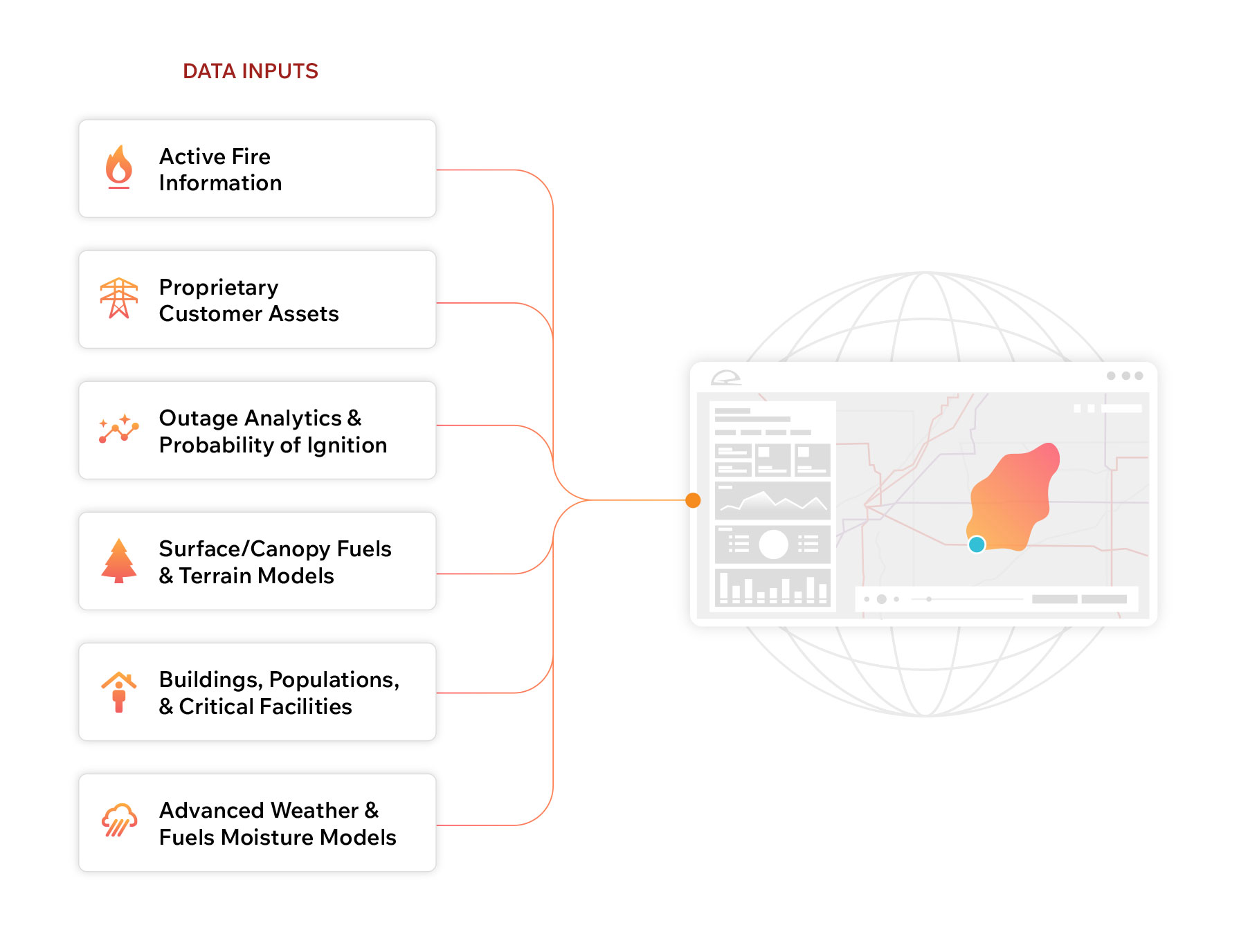

Prioritize your mitigation investments with powerful insights from historical weather patterns and climatology. By combining millions of validated fire simulations, proprietary asset data, and learnings from history’s most dangerous weather, our wildfire fire and extreme weather models help you plan for resilience against potential catastrophic consequences.

Prioritize your efforts. Prevent catastrophic events.

Our fire and extreme weather planning capabilities are the industry standard for predictive results. By using historical data to predict the individual risk associated with each asset, our enhanced WRF models balance consequences versus likelihood, so you can make informed decisions based on what is most probable–not just what’s possible.

- Determine which assets are most likely to fail and cause an ignition

- Calculate potential risk reduction for asset hardening projects

- Identify where, when, what, and who will be impacted

- Validated by working with fire agencies

What you can do with our fire and extreme weather planning capabilities

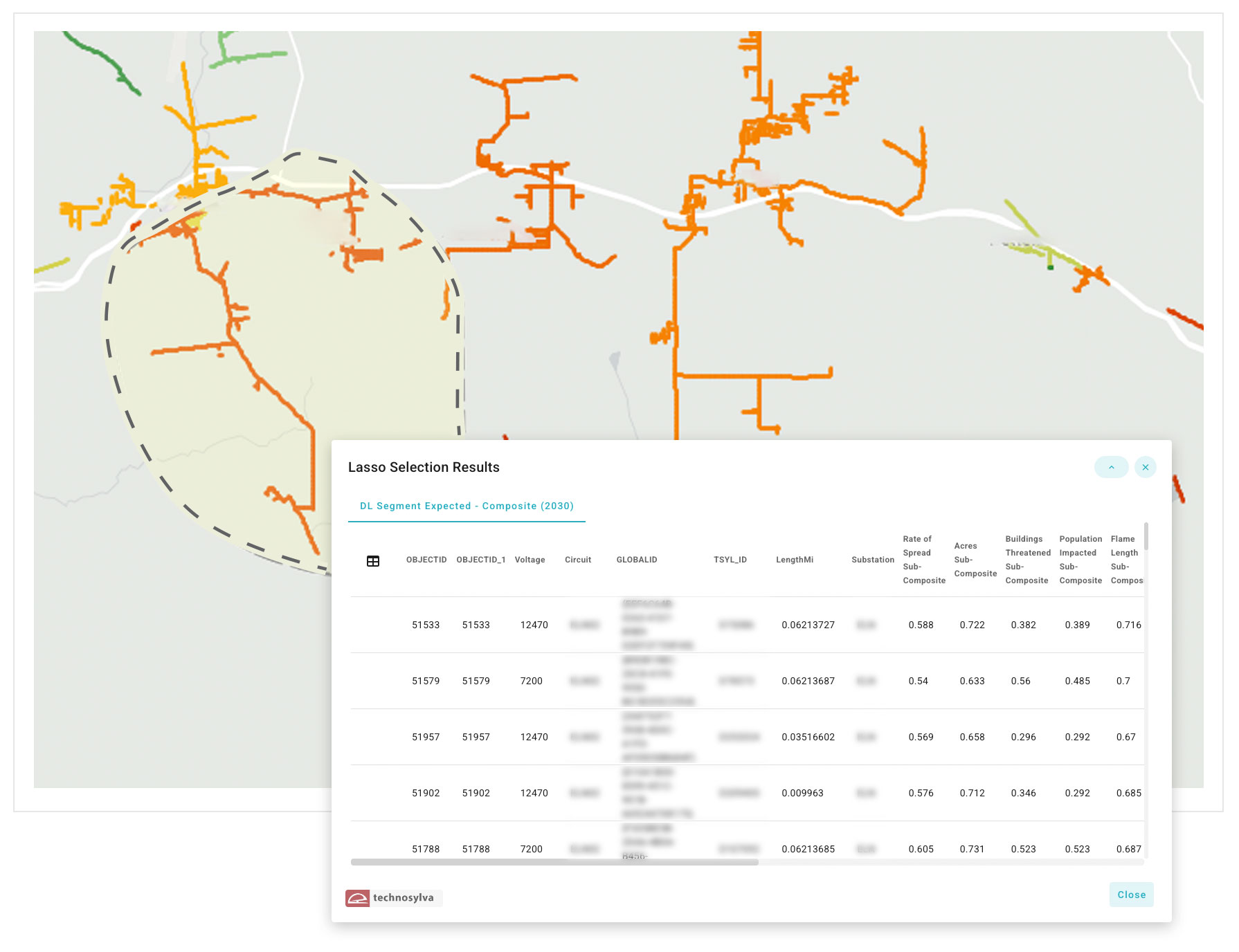

RISK MITIGATION MODELING

Know which assets to harden.

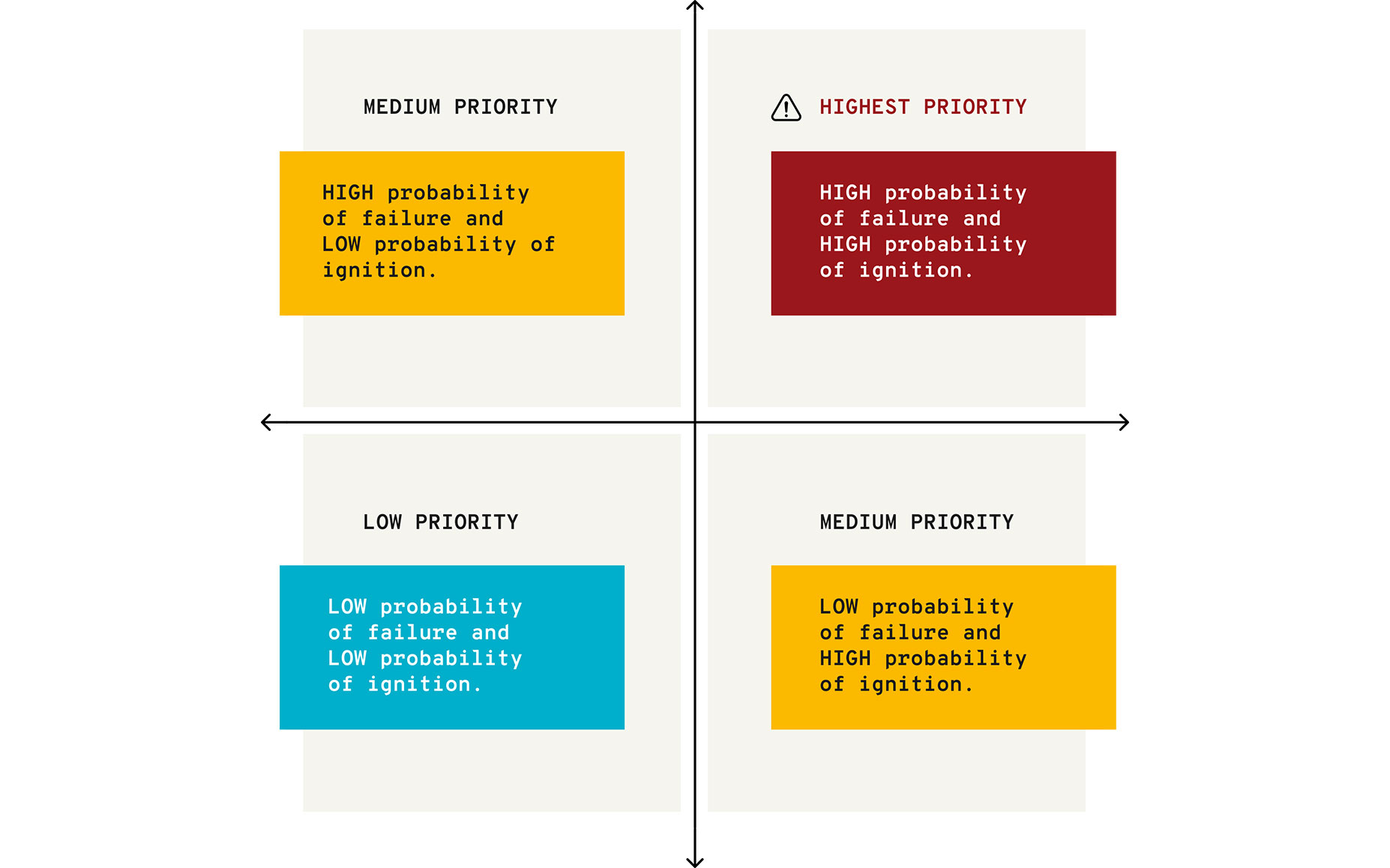

Our fire and extreme weather planning capabilities determine asset risk using wildfire modeling that provides consequence measures estimating acres burned, buildings destroyed, and population impacted. This helps electric utilities focus on assets with the highest probability of failure and ignition, as well as those with lower failure risk but high ignition potential. These insights are built on understanding the likelihood of outages and ignitions.

Understand outage and ignition risk.

Outage and ignition probabilities are calculated across conditions, from typical fire seasons to rare extremes.

Probability of

Outage & Failure:

The likelihood that a system will experience loss of service.

Our fire and extreme weather planning capabilities use statistical models to predict hourly outage probabilities using wind and asset attributes.

Probability of Ignition:

The likelihood that a fire will start due to specific conditions.

Our fire and extreme weather planning capabilities use fuel type, fuel dryness, and wind speed to estimate the chance of fire ignition from a specific source.

IMPACT & LIKELIHOOD

Make better decisions.

A 1 in 100 year wildfire may not be the most likely event, but it can create the greatest risk, including lawsuits, major losses, and even bankruptcy. Our planning tools show both the potential impact of a wildfire from your assets and the probability of which assets are most at risk.

RISK REDUCTION DATA

Strengthen your WMP.

Write a Wildfire Mitigation Plan that makes the strongest case for your top priorities. Quantify risk reduction and risk/spend efficiencies with detailed analysis and reports about your highest risk assets from our planning capabilities.